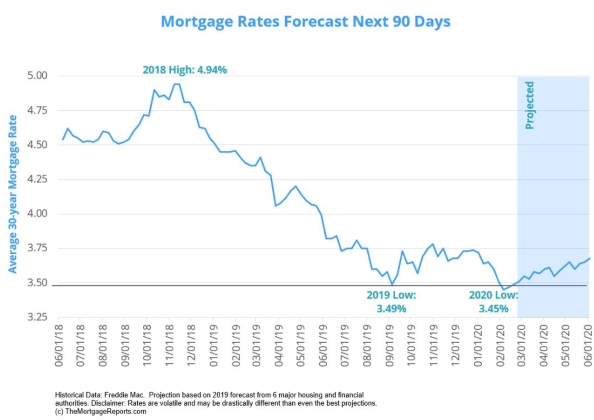

Will mortgage rates go down in March 2020? Mortgage rates forecast for March 2020 March should be another stellar month for mortgage rates. Rates hit a 3.5-year low in February

Tag: Mortgage Rates

Rates DROP while Applications SURGERates DROP while Applications SURGE

As mortgage interest rates dropped to their lowest levels in over a year last week, home owners and buyers raced to submit their refinance and other loan applications before rates