Realtor Associations Forecast Changes Due to COVID-19 Outbreaks As the novel coronavirus disease, COVID-19, continues to spread throughout the United States, the residential real estate market is continuing to feel

Tag: House

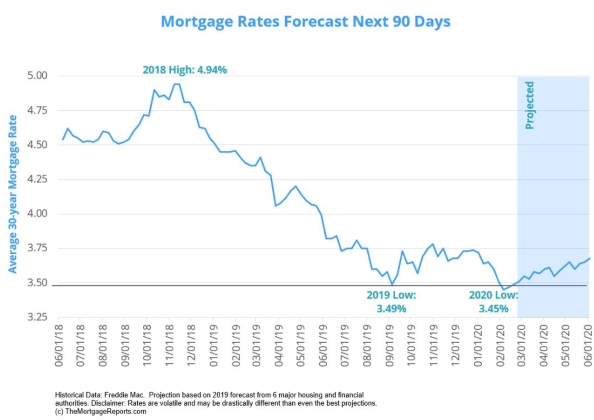

Potential of Mortgage RatesPotential of Mortgage Rates

Will mortgage rates go down in March 2020? Mortgage rates forecast for March 2020 March should be another stellar month for mortgage rates. Rates hit a 3.5-year low in February

NEW NAME – Green Isle Real Estate & MortgageNEW NAME – Green Isle Real Estate & Mortgage

NEW YEAR BRINGS NEW EXCITING CHANGE!!! Green Isle has been engaged in real estate in the Greater Sacramento Area for over 13 years and has now made a HUGE addition

2020 Market Predictions!2020 Market Predictions!

2020 Real Estate Outlook: Expert Predictions For Mortgage Rates, Home Prices, Tech And More The 2019 housing market has been one of low rates, high demand and limited supply—particularly on

Some Christmas Decorating Tips!Some Christmas Decorating Tips!

Just Four Christmas Decorating Trends Who’s ready to change up their holiday decorating this year? I understand it may be difficult to branch away from the same way you’ve been

Creating Positive Workplace CultureCreating Positive Workplace Culture

How To Create A Positive Workplace Culture A workplace culture is the shared values, belief systems, attitudes and the set of assumptions that people in a workplace share. This is

Happy Thanksgiving!Happy Thanksgiving!

Thanksgiving offers us an annual pause from the pace of life to return to places we do not often visit and gather with people we do not often see. The

Why Buy or Sell Real Estate in winter months?Why Buy or Sell Real Estate in winter months?

5 Surprisingly Smart Reasons to Buy a Home During the Holidays Turkeys and tinsel, dreidels and pumpkin pie. Yes friends, the holidays are here again, and it’s the perfect time

Avoid home-buying challengesAvoid home-buying challenges

7 Home Buyer Challenges & How to Avoid Them 1. Not figuring out how much house you can afford Without knowing how much house you can afford you might waste

NOT the same old Rent vs. Buy!NOT the same old Rent vs. Buy!

READY, PRE-APPROVE, SEARCH, GO!!! Renting a place to live may give you the freedom to move when you want and relieve you of the responsibilities of homeownership, but at some