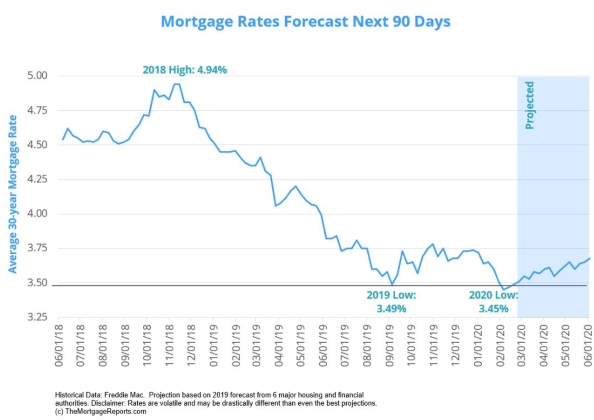

Will mortgage rates go down in March 2020? Mortgage rates forecast for March 2020 March should be another stellar month for mortgage rates. Rates hit a 3.5-year low in February

Tag: Home loans

Why Buy or Sell Real Estate in winter months?Why Buy or Sell Real Estate in winter months?

5 Surprisingly Smart Reasons to Buy a Home During the Holidays Turkeys and tinsel, dreidels and pumpkin pie. Yes friends, the holidays are here again, and it’s the perfect time

Avoid home-buying challengesAvoid home-buying challenges

7 Home Buyer Challenges & How to Avoid Them 1. Not figuring out how much house you can afford Without knowing how much house you can afford you might waste